PM launches economic governance reforms

Publishing date: 01 January 2026

Published in: DAWN

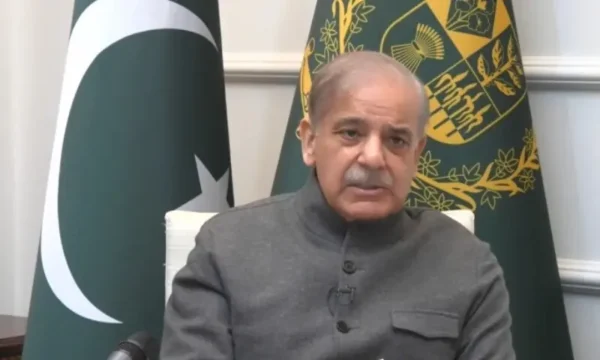

Prime Minister Shehbaz Sharif on Wednesday launched the government’s Economic Governance Reforms, saying Pakistan had moved out of “economic firefighting” after two years of politically difficult decisions that, he claimed, restored macroeconomic stability, pushed inflation down to 4.5 per cent and lifted foreign exchange reserves to over $21 billion.

Speaking at the launch ceremony, the prime minister said the government inherited an economy in early 2024 marked by nearly 30pc inflation, critically low reserves, weakened state institutions and Pakistan’s marginalisation from global economic engagement. He said the scale of the crisis left no room for shortcuts or populism.

PM Shehbaz said restoring stability required “hard choices” that spared no political constituency, including the withdrawal of “unsustainable” subsidies, tighter fiscal discipline, stronger public financial management and the start of long-delayed privatisation reforms. “These were not cosmetic fixes but unavoidable structural reforms,” he said.

The prime minister said inflation had fallen from 29.2pc to 4.5pc, while foreign exchange reserves had increased from $9.2bn to over $21bn. He said the current account position improved from a $3.3bn deficit to a $1.9bn surplus, and Pakistan moved from a primary deficit to a primary surplus while narrowing the overall fiscal deficit.

Insists ‘firefighting’ is over as 142 reform actions rolled out

He said revenue reforms were beginning to address long-standing distortions, with the tax-to-GDP ratio rising from around 8pc to over 10pc and more than one million new taxpayers added to the formal economy.

Tax collection grew by 26pc in 2025, he said, attributing part of the improvement to large-scale digitisation.

He said the e-procurement platform, ePADS, now covered more than 1,000 federal agencies and over half a million contracts, and was integrated in real time with the Federal Board of Revenue, Nadra and the Securities and Exchange Commission of Pakistan.

He said the privatisation of Pakistan International Airlines and First Women Bank marked a break from decades of inaction, with further state-owned enterprise reforms under way. Pakistan’s stabilisation and reform momentum, he added, had been acknowledged by international credit rating agencies and development partners.

“With macroeconomic indicators stabilised, our focus now shifts to accelerating growth, expanding exports and making Pakistan a far easier place to do business,” the premier said, describing the agenda as a shift from crisis management to institution-building.

PM Shehbaz said the reforms comprised 142 actions — including 59 priority reforms and 83 complementary measures — to be implemented by 58 institutions within defined timelines. He said key areas included taxation, energy, privatisation, state-owned enterprises, pensions, tariff rationalisation, regulatory simplification, rightsizing of the federal government and digital governance.

Calling the programme a “home-grown” and “irreversible” agenda aimed at embedding stability into institutions and enabling sustainable, private-sector-led growth, the prime minister said: “The people of Pakistan have paid a heavy price. We cannot return to business as usual, and we will not look back.”

Earlier, Finance Minister Muhammad Aurangzeb presented an overview of the framework and recent economic indicators. He said GDP growth reached 3.1pc in FY25 and accelerated to 3.71pc in the first quarter of FY26, while inflation remained around 5pc in the first five months of FY26 despite climate-related shocks.

He said fiscal discipline had been reinforced through consecutive primary surpluses, including a 2.7pc surplus of GDP, while the tax-to-GDP ratio rose to 10.2pc in FY25, the highest in 25 years. Public debt declined to about 70pc of GDP from 75pc in FY23, he said, while early debt repayments generated interest savings of Rs3.5 trillion. The policy rate, he added, had been reduced to 10.5pc from 22pc in June 2024.