The contracts

28 March 2024

Published in: Business Recorder

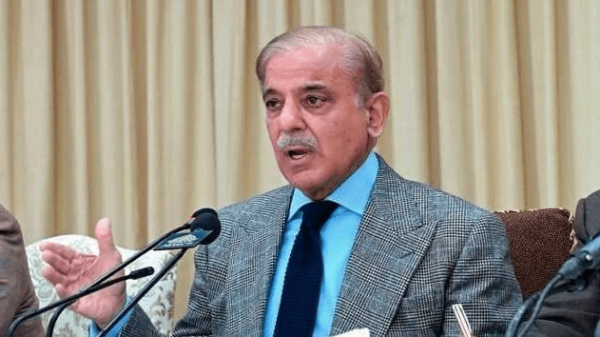

Prime Minister Shehbaz Sharif while chairing a meeting on Reko Diq mining project – with the Chief Executive Officer of Barrick Gold participating through videolink – directed that foolproof security be provided to those working on the project as well as logistics for transport from Reko Diq to Gwadar port.

In March 2022, the government of Pakistan and Barrick Gold reached an agreement (though the original agreement was reached more than 20 years ago in 1993) where the Chilean company Antofagasta withdrew from the project, and the remaining member of the consortium Barrick Gold agreed to: (i) hold half of the shares with the Balochistan government holding the other half; (ii) 10 billion dollar investment that would create 8,000 jobs; and (iii) waiving the 1.1 billion dollar penalties on Pakistan imposed by ICSID and London Arbitration.

Nine months later in January 2023, Barrick Gold and the Chief Minister of Balochistan signed a memorandum of agreement which noted the timetable for disbursement of funds, including advance royalties, special development funds and release of 32 million dollars as first advance.

The example of Reko Diq epitomizes the economic burden borne by the Pakistani taxpayers for unilateral decisions that are challenged not only by the opposition, on occasion merely for the sake of opposition, and in domestic courts and which then lead to the levy of hefty penalties at international arbitration fora at the taxpayers’ expense. It is, therefore, critical for the government to seek a political and across-the-board consensus before implementing any policy.

However, another lesson that is equally critical for the administration to absorb is the need to have a legally highly competent team to review all proposed contract documents with a fine-tooth comb to ensure that there are no clauses that can present a challenge in domestic courts as well as in the international arbitration fora, notably ICSID and London Arbitration Court, for possible redress.

In addition, the government must employ a team of economic negotiators who are capable of looking not only at the positive short-term elements; for example, the inflow of the much-needed foreign exchange, but also be able to project the positive/negative medium to long-term impacts of the contract. In the country’s recent history, Independent Power Producers (IPPs) were lured with extremely attractive incentives devoid of any risk (normally an underpinning of all entrepreneurial activity) inclusive of take or pay, repatriation of profits in dollars and guaranteed fuel import – under policies dating back to 1994 till 2018 – which today account for rising tariffs, a major contributor to inflation, that have led to lower domestic consumption triggering off the capacity payments to IPPs that IPPs are finding increasingly difficult to repatriate, given Pakistan’s extremely low foreign exchange reserves.

Structural and time-bound quantitative across-the-board reforms have been unhesitatingly pledged by the newly elected government with the explicit understanding that the country has no room for manoeuvre like in the past. Additionally, given the present juncture of Pakistan’s continuing economic impasse the government must focus on good governance in all sectors, ending the existing elite capture as stated by the Prime Minister and last but not least taking decisions that are economically and legally sound from the perspective of the public that the government has pledged to serve rather than taking directives from powerful stakeholders – be they domestic with political negative outcomes or international.